Posts Tagged ‘finra’

Sichenzia Ross Ference Carmel LLP Ranked Number One Most Active Issuer Counsel Among Securities Law Firms Nationwide in PlacementTracker’s PIPE and Private Placement Markets League Tables for 2024

NEW YORK, Jan. 29, 2025 — Sichenzia Ross Ference Carmel LLP (“SRFC”) announced today that it was named the number one “most active” securities law firm for Confidentially Marketed Public Offerings, Registered Direct, Private Placement, and At-the-Market (ATM) Offerings in PlacementTracker’s 2024 PIPE and Private Placement Markets League Tables, with 42 transactions, totaling $241.7 million.…

Read MoreSichenzia Ross Ference Carmel LLP Closes Over 130 Capital Markets Transactions Valued at Over $1 Billion in 2024

NEW YORK, Jan. 28, 2025 — Sichenzia Ross Ference Carmel LLP (“SRFC”), a full-service law firm internationally recognized for its securities and litigation practices, reported that in 2024 it closed over 130 transactions, ranging from $400,000 to $85 million, with the total value of these transactions surpassing $1 billion, surpassing its strong performance in 2023 by…

Read MoreCMF Wins FINRA Expungement of Customer Complaint for Registered Representative

Press Release – New York, NY – June 24, 2020 – Securities and corporate law firm Carmel, Milazzo & Feil LLP announced today that it obtained a FINRA arbitration award (Case No. 19-00448) recommending expungement relief to a broker client of any and all references to a customer arbitration and despite the climate of denial of…

Read MoreCarmel, Milazzo & Feil Obtain Successful Appeal and Vacatur of FINRA Disciplinary Finding

Press Release – New York, NY – April 13, 2020 – Securities and corporate law firm Carmel, Milazzo & Feil LLP announced today that attorneys Timothy Feil, Esq., and Craig Riha, Esq., obtained an appellate decision from the National Adjudicatory Council (“NAC”), the Financial Industry Regulatory Authority (“FINRA”) committee that reviews FINRA disciplinary proceedings, for their client…

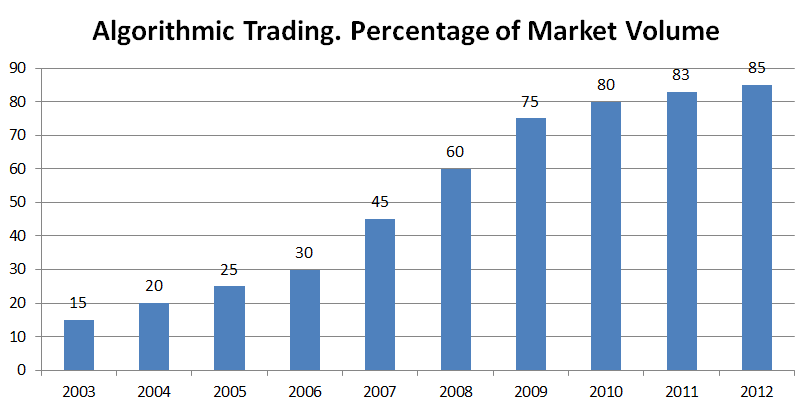

Read MoreFINRA Seeks to Require Registration of Persons Who Develop Algorithmic Trading Strategies

FINRA has filed a proposed rule with the Securities and Exchange Commission (“SEC”) that would require associated persons of FINRA member firms who are responsible for the design, development or significant modification of an algorithmic trading strategy to register with FINRA. The proposed rule would also require the registration of persons who are responsible for…

Read More